Three listed insurers in Singapore outperform MSCI world index

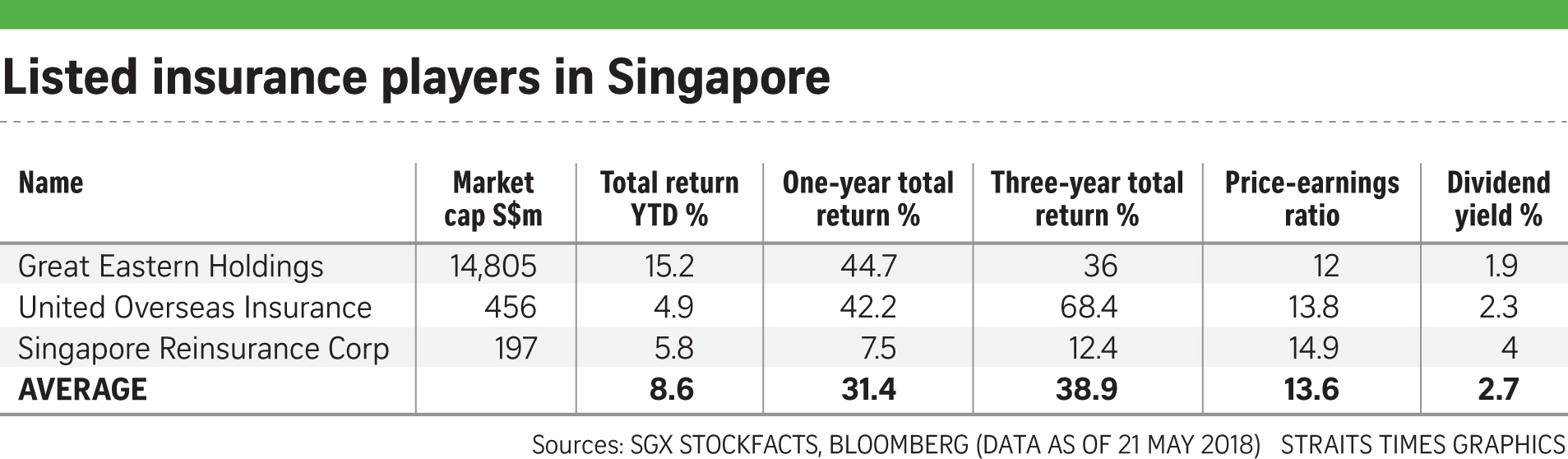

The three listed insurance firms in Singapore have produced an 8.6 per cent total return so far this year, outperforming the 1.8 per cent gain in the MSCI World Insurance index.

The Singapore Exchange has three listed stocks in the insurance sector - Great Eastern, United Overseas Insurance and Singapore Reinsurance Corp - with a combined market value of $15.5 billion. Their 12 month-return is about 31.4 per cent.

Analysts say that while intensified competition and economic uncertainty provide challenges, the insurance industry is expected to further diversify distribution channels while exploring digital innovation.

Two of the three listed insurers recorded profit rises recently.

Great Eastern's earnings for the first quarter rose 68 per cent to $152.9 million, due mainly to higher profits from the Singapore insurance business offsetting losses from changes in the fair value of investments arising from unfavourable market conditions.

Singapore Reinsurance Corp chalked up an 11.6 per cent gain in net profit.

However, earnings at United Overseas Insurance fell 35.5 per cent to $4.5 million based on a new basis of preparation of accounts. Based on the previous basis, there would also have been a decline.

A recent report by professional services firm PwC noted that a strong regulatory environment and the entry of a number of global companies and brokers have seen Singapore established as a key regional centre for insurance and reinsurance.

Domestically, the penetration of life and health products continues to increase.

The challenges for the insurers, said PwC, is to strengthen customer relationships and develop tailored and targeted products in the face of increasing customer demands and competition.

Monetary Authority of Singapore deputy managing director Ong Chong Tee said in March that an insurance firm's long-term success must be built on a strong risk culture and good corporate governance.

He added that the insurance sector will not be immune to the innovations and disruptions around it, which will bring both opportunities and challenges.

In the PwC report, which surveyed insurance executives around the world, 85 per cent of chief executive officers are concerned about the pace of technological change, more than bosses in almost any other industry.

However, their mood is increasingly positive given that the anticipated disruption from incoming competitors has not materialised to the extent that was feared.

Adapt From: Straits Times, 28 May 2018